Thinking of Trading in the Indian Stock Market? Read This First.

August 24, 2025

Headlines in one glance

-

GIFT Nifty ~ 24,640–24,660 before open; indicating a flat-to-soft start (~-30 to -50 pts vs Nifty futures prev close). mintEquitypandit

-

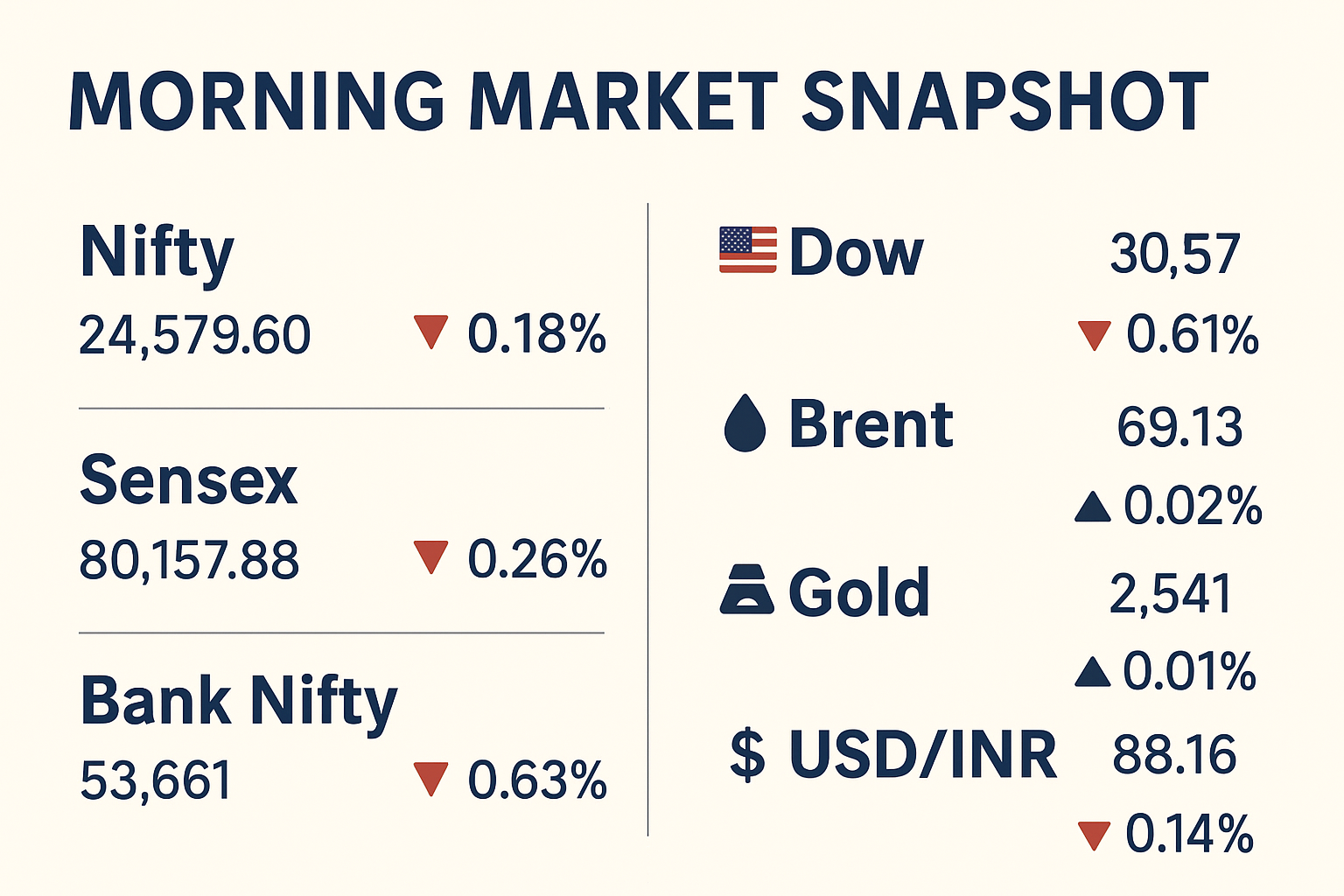

Wall Street (Tue, Sept 2): Dow -0.6% | S&P 500 -0.7% | Nasdaq -0.8% — tariff/legal noise + higher yields weighed on tech. Reuters

-

Crude: Brent ~$69.1/bbl (steady in Asia). Gold near record highs; yields firm; dollar stronger. Reuters+1

-

Rupee: NDF points to ₹88.04–88.08 at open (vs 88.16 prev), i.e., a slightly firmer start. Reuters

-

Domestic watch: GST Council meet (Sept 3–4) could sway sentiment intra-day. NDTV Profit

India Snapshot (Previous Session: Tue, 2 Sept)

-

Nifty 50: 24,579.60 (-0.18%)

-

Sensex: 80,157.88 (-0.26%)

-

Bank Nifty: 53,661 (-0.63%)

Profit-taking from higher levels; banks underperformed. NDTV Profitmint

Volatility

-

India VIX ~ 11.3–11.4 (low, stable). Yahoo Finance+1

Flows (Cash, provisional) — Tue, 2 Sept

-

FII: ₹-1,159 Cr (net sell)

-

DII: ₹+2,550 Cr (net buy) Trendlyne.comMoneycontrol

Early Read — GIFT Nifty

-

Prints clustered 24,640–24,660 into the open; bias: mild negative vs Nifty futures close. Expect initial dip-buyers near 24,600/24,550, supply toward 24,700/24,750. mintEquitypandit

Levels That Matter Today

Nifty 50 (spot reference: 24,579)

-

Supports: 24,500 (heavy Put OI), then 24,400 / 24,300–24,200

-

Resistances: 24,700 (max Call OI), then 24,750 / 24,800

-

Setup: Range 24,500–24,700 is pivotal; break & hold decides trend. mint

Bank Nifty (spot ref: 53,661)

-

Supports: 53,575 (200-DEMA zone), then 53,200–53,000

-

Resistances: 54,000 / 55,000

-

Note: Below 53,575 opens room for momentum lower; holds may fuel a pullback. mint

Global Cues (What’s driving risk)

US Close (Tue)

-

Tech-led selloff on tariff/legal uncertainty + higher long yields; PepsiCo rose on activist stake; Kraft Heinz fell. Jobs report due Fri (Sept 5). Reuters

Asia Open (Wed)

-

Nikkei/Hang Seng softer; sentiment cautious on global fiscal worries & yields; gold at/near record, oil steady. Reuters+1

Commodities & FX

-

Brent ~ $69.1; WTI ~ $65.6 (steady after US sanctions news). Reuters

-

Gold: near record highs as haven demand persists. Reuters

-

Dollar: broadly firmer vs majors; USD/INR NDF hints at a slightly stronger rupee on open. Reuters

Data & Events Dashboard (Today, IST)

-

India: GST Council Day 1 (policy tone for consumption sectors). NDTV Profit

-

US later in week: Non-Farm Payrolls (Fri, Sept 5) — keeps global risk sensitive into the weekend. Reuters

Game Plan for Retail Traders (intraday)

-

Bias: “Fade extremes” within 24,500–24,700 on Nifty until a decisive break.

-

If gap-down near 24,520–24,500 and holds 15–30 mins → look for mean-reversion buys toward 24,640/24,700 with tight stops.

-

If push to 24,700–24,750 fails → consider fade toward 24,600.

-

Bank Nifty: Watch 53,575 — structure shifts if this gives way; below it, avoid bottom-fishing.

-

Risk: Low VIX can snap — size down, use hard stops.

Sector & Stock Thoughts (very brief)

-

Rates/yields up → pressure on duration-sensitive pockets (high-PE tech, richly-valued defensives).

-

Oil steady → neutral for OMCs near term.

-

Gold at highs → bullion names bid on dips (tactically). Reuters+1

Notes:

-

All levels are spot unless stated. Use your own execution rules.

-

Sources: live market snapshots and credible media wires referenced inline.